Cold trading - how is it done?

Ever wondered how these guys with no interest in horse racing can make steady profits by trading? Cold traders read the market and profit from its trends rather than studying the form.

Betfair is modelled on the stock market and a growing group of customers now use the platform to trade sports markets, particularly horse racing, in a similar fashion to financial city traders.

Instead of buying and selling shares or commodities these traders trade the No 2 at Wolverhampton on a Monday afternoon or Denman in the Gold Cup to make profits.

Users who trade horse racing markets in the style of financial city traders are termed cold traders.

Operating in the last 10-15 minutes before a race starts, traders aim to lock in small regular profits regardless of the race result.

As soon as the race starts they simply move onto the next race and trade again.

Trainers,

jockeys and form are irrelevant as the eventual outcome of the race does not affect the traders. The less they know about the horses the better, it prevents them from forming any opinions or having any emotional attachment to any bet.

Volatility and heavy liquidity in the market is all that interests these individuals.

Cold traders operate in all UK and Irish races and account for a large sum of the total volume traded in the win market.

Operating at the top end of the market around the favourite cold traders are fantastic for all users of the site. The shorter the price of the favourite, the more they get involved. (You need a bigger bank to lay first if the favourite is 6.6).

They provide depth to the market and enable traditional punters to place substantial back or lay bets pre-race.

It should be emphasised that cold traders operate purely pre-race and many successful traders prefer to be out of the market in the last couple of minutes before the race starts.

Example figures

The following figures were taken from a standard race at Wolverhampton.

The vast majority of the volume matched in the last 15 minutes of the race is a result of cold trader activity. It's been estimated that in the last five minutes of a standard UK race, over £1,500 per second is getting matched!

£93,831 16:05pm

£201,969 16:08pm

£275,969 16:10pm

£341,759 16:12pm

£431,250 16:14pm

£558,169 16:15pm

When cold trading it's important to adhere to the golden rule of Betfair: BACK HIGH LAY LOW!

Think about share prices. If you were looking to guarantee a profit on an investment you would buy at a low price and sell at a high price.

Your profit would be the difference in the two prices.

In Betfair terms buying is laying and selling is backing but unlike shares you can do either transaction first, you can sell something before you effectively own it!

The following example is from the race outlined above.

The trader has focused on the favourite where the vast majority of the betting and volatility.

Given the volatile nature of horse racing markets it's inevitable that some trades will go against you. This is where the vast majority of novice cold traders and recruits from traditional gambling go wrong.

In the example above imagine if the horse had drifted. What would the trader do? Leave it as a speculative £50 bet as its price drifts.

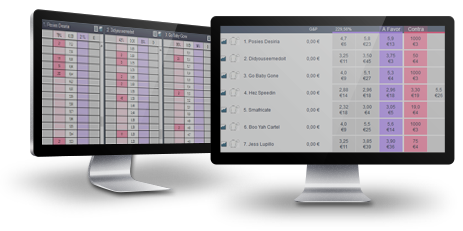

To give yourself the best chance of success at cold trading it's advised to equip yourself with the correct tools such as Bet Angel,

Bet Trader Pro, FairBot or BFExplorer.

These API programmes are specifically designed for cold trading.

Giving a greater level of information on expected price movements with functions such as moving averages, weight of money indicators and many of the applications used by city traders they offer far more than the standard Betfair interface, that's not to say it can't be done.

Golden rules for cold trading:

This is still gambling, it is not a guaranteed way to make profit.

Cold trading is specifically pre-race. Never leave trades to go in-play.

Be prepared to accept small losses. This is the most important aspect of cold trading.

If your downside is no bigger than your upside, you just need to be right more times than wrong. If your downside is much bigger than your potential profit, then you might as well be backing 1.2 shots.

There is always another race.

Invest in the right tools to give yourself the best chance of success.

The majority of people who attempt cold trading fail because they attempt to mix punting and trading. To profit from trading, discipline is the most important factor.